“It seemed like a good idea at the time.”

As a liberal arts grad with mountains of debt and molehills of direction, I took an analyst job at a top NYC investment bank. Neck-deep in spreadsheets and working around the clock, I fought to keep my head above water in a sea of brilliant, khaki-clad sociopaths. While the money and education were great, I quickly learned how the finance world really works... and I wanted no part of it. After 9/11, I left for good.

Interestingly enough, there were a handful of ex-military analysts in my class. And as you might imagine, most were great analysts because they could handle the workload without complaint. That said, most were from top schools (West Point, etc.), so I'm sure that played a part in their recruitment. I'm not sure what school/program you're coming from, but as with any applicant, a concentration in finance, business, engineering, and/or computer science will increase your chances. I'd also recommend tracking down current bankers who went through the same military program as you – I can't imagine they wouldn't at least put your resume in the right hands.

It's a plus, but probably won't make or break one's candidacy. Obviously a CFA is more likely to have financial fluency than a non-CFA, but speaking from my own experience, I saw very few CFA's in banking. Saw far more CFA's in sales & trading, compliance, accounting, etc.

I've answered similar questions elsewhere in this thread, so please feel free to poke around a bit.

Re: age... assuming you want to enter an analyst program, it *could* be an issue. Obviously employers can't legally discriminate on the basis of age, but with rare exceptions, analysts start at 22, right out of college. I guess I just haven't seen enough examples similar to your situation to be able to suggest otherwise.

Gender: not an issue. It might even work in your favor, as banks look to level the playing field.

The so-so school part can definitely be a sticking point, at least for the bulge-bracket banks. But as I said to another question-asker coming from a "meh" school, you should (a) consider starting with smaller, boutique banks (arguably a better working experience, less particular about diplomas, and can act as a springboard), and (b) connect with alumni from your school who have gone the banking route.

Business school may also be an option. B-school graduates who go into banking immediately assume associate positions, so you could side-step the analyst programs altogether.

The truth is that after freshman/sophomore year, your internships don't matter THAT much in terms of career direction. It's what happens after junior year and graduation that counts. Of my college friends who went into banking, the majority did traditional "summer jobs" after freshman/sophomore year (e.g. camp counselors, lifeguards, waiters). But, if you're 100% sure you want to go into banking, internships at local financial institutions of any kind – commercial banks, investment firms, stock brokerages – are a good move.

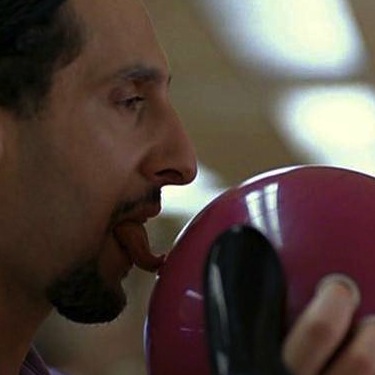

Bowling Alley Attendant

What do bowling alleys do to keep those nasty shoes clean/sanitary?

What do bowling alleys do to keep those nasty shoes clean/sanitary?

Hotel Employee

Can you give guests room upgrades at your sole discretion?

Can you give guests room upgrades at your sole discretion?

Obstetrician Gynecologist

If a baby has health complications resulting from a difficult delivery, do you ever feel guilty?

If a baby has health complications resulting from a difficult delivery, do you ever feel guilty?

Personally I don't think anyone's too old to get into any profession, though at 39 I doubt you'll be cast as a child actor any time soon.

As for banking, it's less about age than it is experience. If you have a quantitative/analytical background working in a particular industry, you could be a candidate to work in a banking group dedicated to that industry. For example, a classmate of mine who worked in the accounting departments of several tech firms is now working as a venture capitalist.

If, however, your career thus far has been completely devoid of analytics and relevant industry expertise, I'd say business school is your best bet to transition into financial industries (including banking).

Good for you for having saved $10K at 20 years old! You're doing better than many people twice your age. That said, you'll want to speak to a financial advisor or commercial banker for that kind of advice. Investment bankers deal more with transactions between companies, as opposed to personal investing. Congrats again and best of luck.

-OR-

Login with Facebook

Login with Facebook (max 20 characters - letters, numbers, and underscores only. Note that your username is private, and you have the option to choose an alias when asking questions or hosting a Q&A.)

(A valid e-mail address is required. Your e-mail will not be shared with anyone.)

(min 5 characters)

By checking this box, you acknowledge that you have read and agree to Jobstr.com’s Terms and Privacy Policy.

-OR-

Register with Facebook

Register with Facebook(Don't worry: you'll be able to choose an alias when asking questions or hosting a Q&A.)